To be a successful in 2025, financing in furniture and mattress retail is a must-have. With the economy on uneven footing and consumers clutching their wallets (yikes, people even resorting to financing their groceries) a solid financing offering is not an option, it’s table stakes.

In furniture and mattress sales, financing is one of the most powerful tools. And the opportunity of financing has a much larger payoff when you look at high-ticket items like furniture and mattresses. As a retailer, financing helps sales associates sell bigger tickets while still giving consumers a great experience and confidence in their purchase.

Here’s a crazy stat: The Consumer Financial Protection Bureau predicts that only about 11% of sales in high-ticket retail, like furniture or electronics, are financed.

With a percentage that small, there’s only one way to look at this – as a massive untapped opportunity.

Financing Is a Retail Superpower

Financing is a high-impact sales lever, leading to bigger tickets, a better experience, and stronger margins. But consumers won’t automatically know that you offer it. You have to bring it up.

The challenge isn’t the financing itself but how sales associates present it.

Wonder understands that, and we have a few ways furniture and mattress retailers can introduce financing.

- Sales associates should promote financing early and often. Signage, product tags, and visible payment options all build awareness. Transparency builds trust. When terms are simple and the application is quick, associates can guide customers with ease.

- Solve the Pain of Declines

One of the biggest frustrations for shoppers is multiple applications. If they get declined once, many walk away.

A financing waterfall solves this problem. One application runs across multiple lenders. Customers don’t feel like they’re starting over.

For RSAs, it’s easy to say: “One quick application, and we’ll find the best approval for you.” This boosts confidence, improves the customer experience, and maximizes approvals without extra effort.

- Partner with the Right Experts

The right financing company truly understands the ins and outs of furniture and mattress sales. At Wonder, we equip our retailer partners with the tools they need and the expert insights that make financing a natural, seamless part of the sales flow.

From Awkward to Advantage: Training Staff to Present Financing That Sells

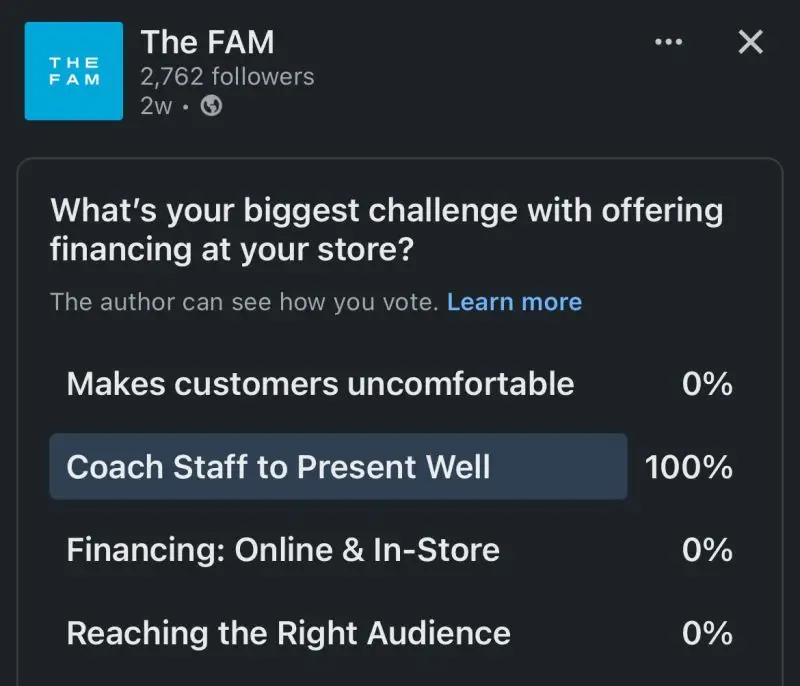

Mattress industry group The FAM recently ran a poll on social media about what retailers’ biggest challenges are when it comes to financing – 100% of respondents said coaching staff to present well.

That’s not a product problem – it’s a people problem. Even the best financing program won’t deliver results if RSAs aren’t confident in how to bring it up.

That’s why we created the Wonder App, a light-weight and an easy-to-use incentive & training platform designed for scale. With the Wonder App, retailers can:

- Deliver consistent training so every RSA explains financing the same way.

- Keep coaching fresh by rolling out new modules whenever financing programs or terms change.

- Motivate action with built-in SPIFs and rewards that encourage RSAs to lead with financing.

- Normalize financing by mentioning it early and often; Present it alongside cash or card.

- Frame affordability: Position financing as a way to spread out costs, not add expense.

- Handle objections with value: Shift the focus from price to benefits.

- Listen actively: As Bob Phibbs (The Retail Doctor) suggests – focus, paraphrase, show empathy.

Coaching should never stop. Keep the team engaged with attainable goals, ongoing training, and regular check-ins.

The #1 Key to Winning With Financing Offers in Furniture Retail

Sales associates may benefit from financing training, but if you want to keep it super simple, the single most effective approach to selling financing is to break down the costs.

A $4,000 sofa sounds expensive. But $150/month sounds doable – and suddenly, that product feels within reach. Financing reframes affordability, builds confidence, and drives higher purchase values.

If we look at the psychology behind financing, financial decisions are often influenced by emotions, cognitive biases, and social factors, rather than purely rational calculations. But if you rationalize it in a digestible way that consumers can relate to, you’re helping educate the consumer.

Financing is only as strong as the people presenting it. Invest in your people, equip them with the right training tools, and watch financing transform from awkward to unstoppable.

Talk to Wonder about making financing your team’s sales superpower.